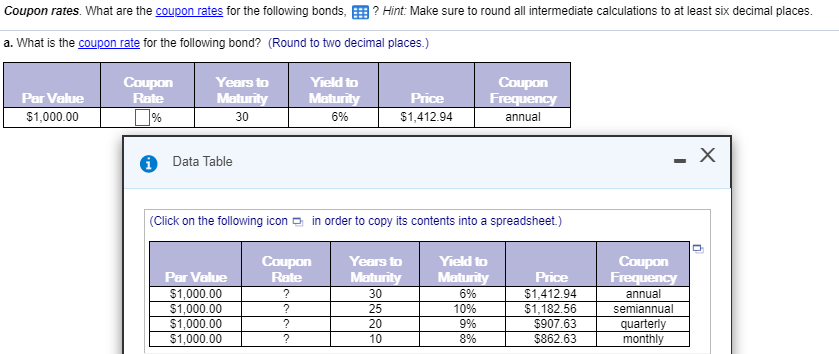

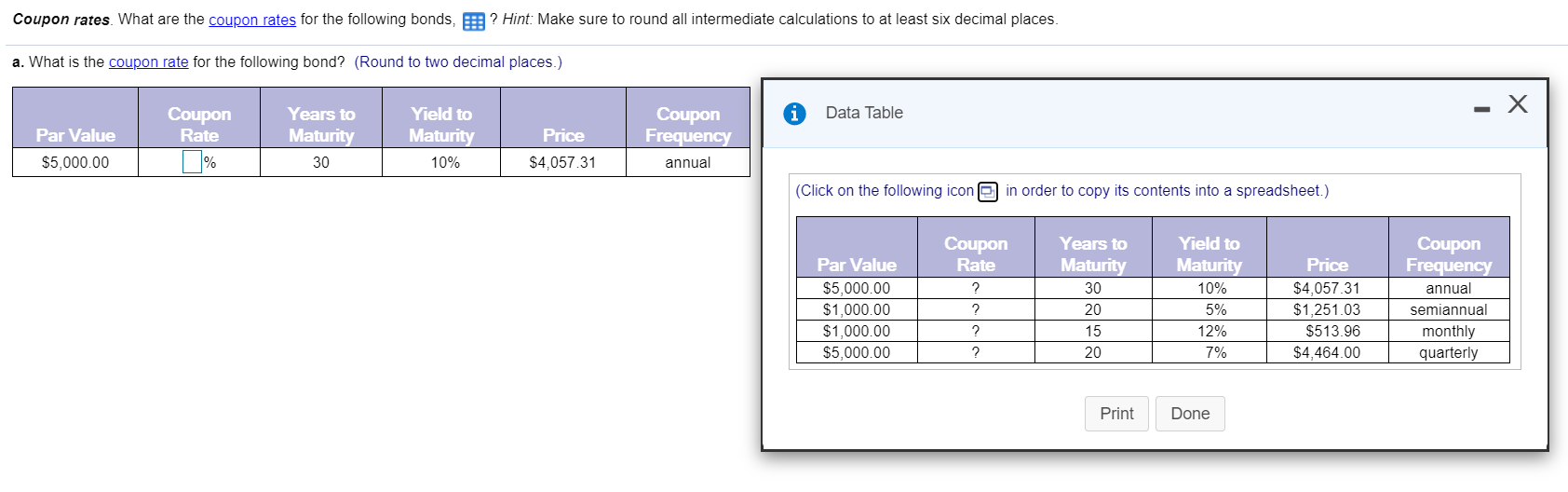

38 what are coupon rates

Coupon Rate Formula | Step by Step Calculation (with Examples) The term " coupon rate " refers to the rate of interest paid to the bondholders by the bond issuers. In other words, it is the stated rate of interest paid on fixed income securities, primarily applicable to bonds. What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate.

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

What are coupon rates

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are ... Coupon rate - definition and meaning - Market Business News The coupon rate is the interest rate that the issuer of a bond pays, which normally happens twice a year. The bondholder receives the interest payments during the lifetime of the bond. In other words, from its issue date until it reaches maturity. Bonds are types of debts or IOUs that companies, municipalities, or governments sell and people buy. Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

What are coupon rates. Difference Between Coupon Rate and Discount Rate What is Coupon Rate? Coupon rates are generally affected by the loan fees set by the government.1 Subsequently, on the off chance that the public authority expands the base financing cost to 6%, any previous securities with coupon rates beneath 6% lose esteem. The coupon rate is communicated as a level of its standard capital. Government - Continued Treasury Zero Coupon Spot Rates* Aug 14, 2013 · Continued Treasury Zero Coupon Spot Rates* Treasury Spot Rates, Office of Thrift Supervision (OTS) Method; End of Quarter, Percent; Maturity 2012 2013; Years $15 Off | Avis Coupon Codes September 2022 Up to 30% off SUV Rentals with Avis Coupon Code: Exclusive Coupon Code: Oct 16, 2022: Up to 35% Off Avis Rental Cars: Exclusive Coupon Code: $15 Off $175 + Up to 30% Off Base Rates: Coupon Code: Oct 1, 2022: Groupon Members Save up to 35% with Avis: Coupon Code: Jan 1, 2023: $15 Off $175+ Reservation (Avis Coupon) Exclusive Coupon Code: Nov 16 ... What is a Coupon Rate? | Bond Investing | Investment U Coupon rates are the static variable in a dynamic bond market. This makes them an important variable in establishing market rates. The Inverse Relationship Between Price and Yield, As bond prices fluctuate and coupon rates stay the same, the yield of a bond changes.

What Is Coupon Rate and How Do You Calculate It? What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger, Close thin, Facebook, Twitter, Google plus, Linked in, Reddit, Email, arrow-right-sm, arrow-right, Loading, Home Buying, Calculators, Budget Car Rental Coupons Budget Car Rental Coupons Save up to 10% on low rates. B112100. Up to 25% OFF Base Rates + up to 10% Donated. Save up to 25% on your car rental base rate and up to 10% of your base rate will be donated to Susan G Komen® for breast cancer research. R899700. Weekly Car Rental Deal. Save up to 10% on Rentals of 5 Days or More. D111800 What is coupon rate | Definition and Meaning | Capital.com A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures. Coupon rate formula, The coupon rate calculations formula is simple. Coupon rate definition - AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Coupon rate definition and meaning | Collins English Dictionary The coupon rate is the interest rate on a bond calculated on the number of coupons per year. A tax-exempt municipal bond has a higher after-tax yield than a ... Coupon Rate - Explained - The Business Professor, LLC A coupon rate refers to the annual interest amount that a bondholder receives usually based on the bonds face value. A coupon rate is the bond interest an issuer pays to a bondholder on its issue date. Any change in the value of the bond changes the yield, a situation that gives yield to maturity of the bond. Back to: INVESTMENTS & TRADING, Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · A bond's coupon rate is the interest earned on the bond over its lifetime, while its yield to maturity reflects its changing value in the secondary market. ... Coupon rates are fixed when the ...

What Is Coupon Rate and How Do You Calculate It? The coupon rate, or coupon payment, is the yield the bond paid on its concern date. This yield modifications as the worth of the bond modifications, thus giving the bond's yield to maturity. The same phenomenon can also be proven for an rate of interest of 4 p.c.

Coupon Statistics - 2022 Update | Balancing Everything Any of the income groups note high coupon redemption rates and lots of users. Below, let's see what percentage of consumers from a certain earning level looks for deals and coupons. Over $200,000 - 86%; $100,000-149,000 - 85%; $20,000-39,000 - 87% (Hawk Incentives) 20. Coupon clipping companies help consumers save millions of dollars ...

Tolling Rates | RiverLink Tolling Rates For passenger vehicles with roof top luggage, accessories, and/or cargo, if the height exceeds 7 ½ feet, you will be charged as a medium vehicle, $5.26 if you have a transponder. Vehicles may be re-classified to a higher rate due to the height of cargo or due to pulling a trailer.

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

What is Coupon Rate? Definition of ... - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Los Angeles Department of Water and Power Jun 01, 2022 · If you are having issues accessing your account, please contact our Rates Application Group at (213) 367-4709. Contact Us. RATES APPLICATION. Phone No: (213)367-4718 ...

Difference Between Coupon Rate and Interest Rate Coupon Rate: Interest Rate: Meaning: A coupon rate is an annual interest payment received by the bondholder on the bonds after the maturity period comes to an end. Coupon rates are issued on fixed-income security such as bonds, mortgage, securities etc.

Bond Yield Rate vs. Coupon Rate: What's the Difference? The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity.

Car Rental Coupons for Discount Rental Cars | Avis Car Rental Save 10% on already LOW RATES at your neighborhood locations K348200 Up to 25% off base rates with 5% donated to Susan G. Komen® A349300 Up to 25% off base rates with 5% donated to Make A Wish® H749900 AARP members save up to 30% off base rates A359807 Up to 25% off base rates for veteran and military family T765700

Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo What is Coupon Rate? The coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is the rate of interest being paid off for the fixed income security such as bonds.

Wild Bill's Airboat Tours ASK ABOUT OUR GROUP RATES (15 OR MORE PEOPLE) All the COOL people come here!!! 352-726-6060. Email Us: ...

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100, Let's understand couponrate calculation with the help of an example.

Coupon Rate | Investor.gov Coupon Rate. The interest rate on a bond. It is expressed as a semi-annual rate. Featured Content. Investing Quiz - September 2022. Test your knowledge of compound interest and more! ...

BUDK Promo Codes and Coupons September 2022 | BUDK.com BUDK Promo Codes. Find the latest coupons and promo codes for BUDK here. Get them direct from the source and know they will work 100% of the time. Don't waste your time on those coupon sites with expired codes and poor success rates. If there is a BUDK promo code listed below, it is guaranteed to work within the date ranges listed.

What is the Coupon Rate? - Realonomics The coupon rate is the interest payments that are made to bondholders, annually or semi-annually, as compensation for loaning the issuer a given amount of money. 6 For example, a bond with par value of $1,000 and a coupon rate of 4% will have annual coupon payments of 4% x $1,000 = $40. Where is the coupon rate on a BA II Plus?

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

Understanding the Relationship Between Coupon Rates and Duration There is a question regarding duration that I continue to struggle with. Which of the following are true: 1 - Lower coupon bonds are more sensitive to interest rates than high coupon bonds. 2 - There is inverse relationship between bond prices and change in interest rates. 3 - There is a positive relationship between coupon rates and ...

What does it mean if a bond has a zero coupon rate? - Investopedia A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this does not mean the...

Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon rate - definition and meaning - Market Business News The coupon rate is the interest rate that the issuer of a bond pays, which normally happens twice a year. The bondholder receives the interest payments during the lifetime of the bond. In other words, from its issue date until it reaches maturity. Bonds are types of debts or IOUs that companies, municipalities, or governments sell and people buy.

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are ...

Post a Comment for "38 what are coupon rates"