42 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest

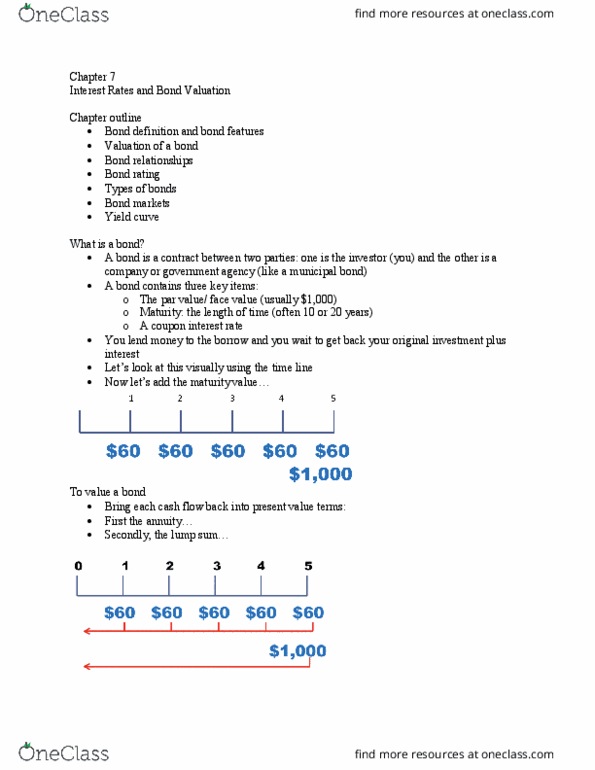

› ask › answersWhen is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · For example, if a company issues a $1,000 bond with a 4% interest rate, but the government subsequently raises the minimum interest rate to 5%, then any new bonds being issued have higher coupon ... en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.

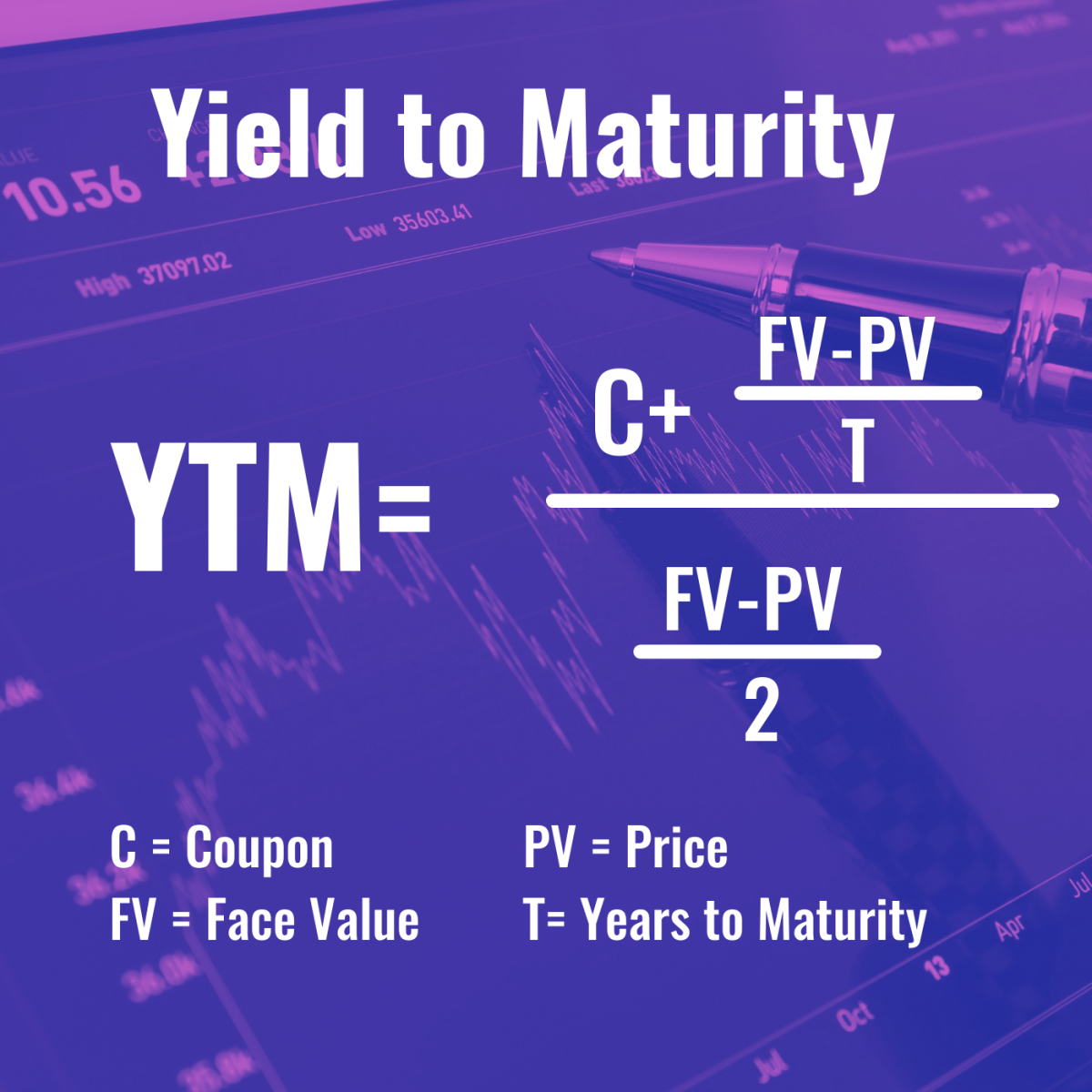

› terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest

en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia This is likely to happen as holders of higher-coupon mortgages can have a larger incentive to refinance. Conversely, it may be advantageous to the bondholder for the borrower to prepay if the low-coupon MBS pool was bought at a discount (<100). This is due to the fact that when the borrower pays back the mortgage, he does so at "par". calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Since zero coupon bonds do not pay a coupon, any capital appreciation remains in the bond. Since they sell at a discount to their stated maturation value they are known as discount bonds. In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. › commonman › EnglishReserve Bank of India The current yield for a 10 year 8.24% coupon bond selling for ₹103.00 per ₹100 par value is calculated below: Annual coupon interest = 8.24% x ₹100 = ₹8.24. Current yield = (8.24/103) X 100 = 8.00%. The current yield considers only the coupon interest and ignores other sources of return that will affect an investor’s return.

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest. › bonds › 07Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond that issues 3% coupon payments may now be "outdated" if interest rates have increased to 5%. To compensate for this, the bond will be sold at a discount in secondary market. › commonman › EnglishReserve Bank of India The current yield for a 10 year 8.24% coupon bond selling for ₹103.00 per ₹100 par value is calculated below: Annual coupon interest = 8.24% x ₹100 = ₹8.24. Current yield = (8.24/103) X 100 = 8.00%. The current yield considers only the coupon interest and ignores other sources of return that will affect an investor’s return. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Since zero coupon bonds do not pay a coupon, any capital appreciation remains in the bond. Since they sell at a discount to their stated maturation value they are known as discount bonds. In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia This is likely to happen as holders of higher-coupon mortgages can have a larger incentive to refinance. Conversely, it may be advantageous to the bondholder for the borrower to prepay if the low-coupon MBS pool was bought at a discount (<100). This is due to the fact that when the borrower pays back the mortgage, he does so at "par".

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

:max_bytes(150000):strip_icc()/bond.asp_final-76c865e23abe4f6c9e7c41a38cfe6e39.png)

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Post a Comment for "42 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest"