45 valuing zero coupon bonds

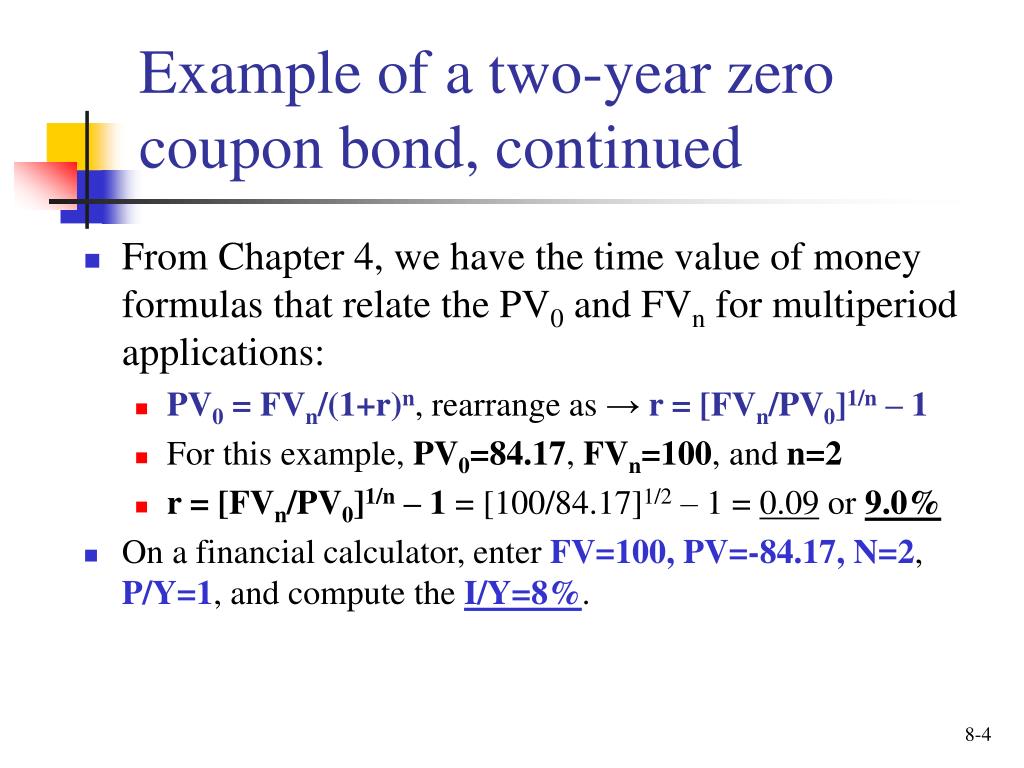

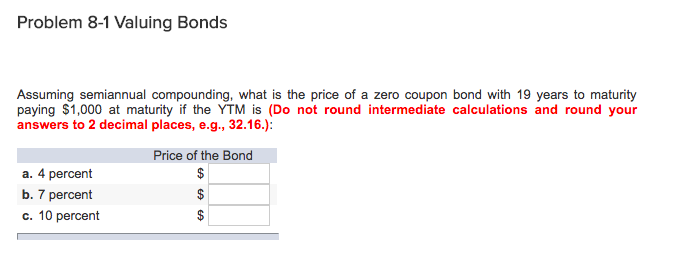

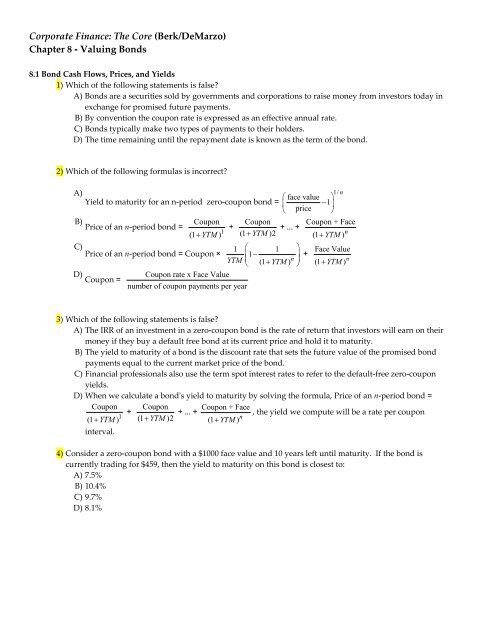

Zero Coupon Bond: Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds ... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

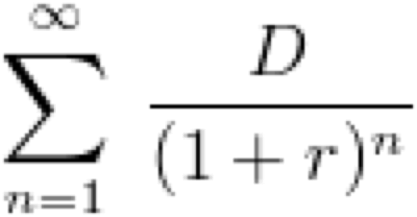

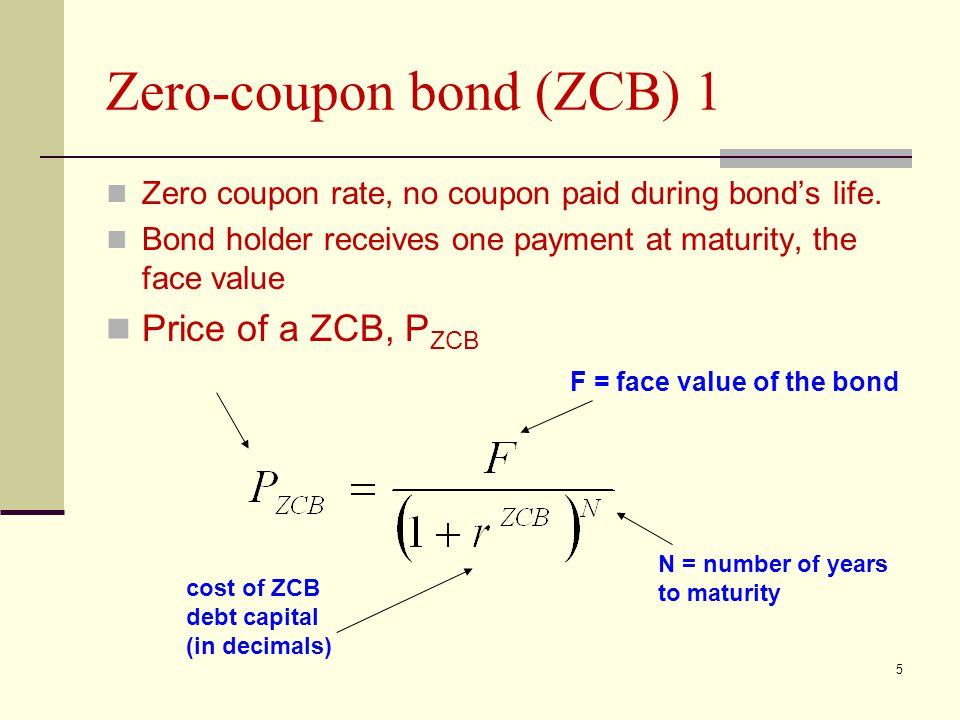

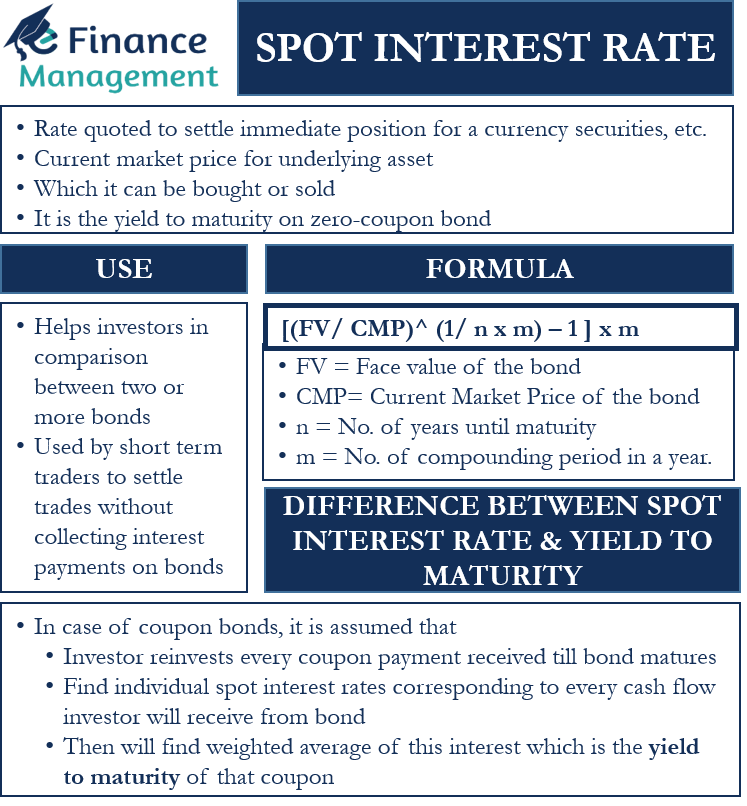

Zero Coupon Bond Calculator - Nerd Counter Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Valuing zero coupon bonds

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For... efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Valuing zero coupon bonds. Zero Coupon Bond Calculator - What is the Market Value? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds › lifestyleLifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Zero - Coupon Bonds - Economy Blatt The yield to maturity of a zero - coupon bond is the return an investor can earn from holding the bond to maturity and receiving the promised face value payment. We can determine the yield to maturity of the one - year zero - coupon bond discussed above. 144,927 = 150,000 / (1+ YTM 1) 1 + YTM 1. 1+ YTM 1 = 1.035. YTM 1 = 3.5%. That is ... What Is a Zero-Coupon Bond? - Investopedia If the debtor accepts this offer, the bond will be sold to the investor at $20,991 / $25,000 = 84% of the face value. Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which...

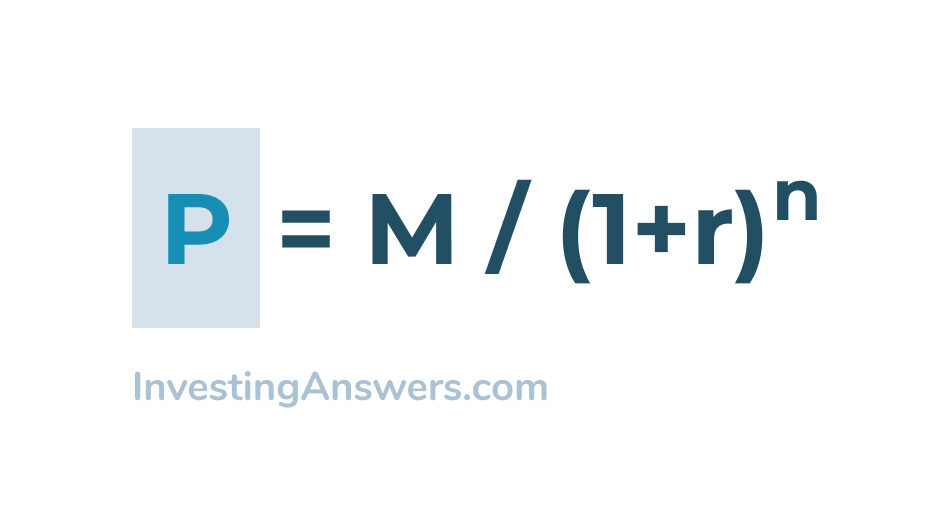

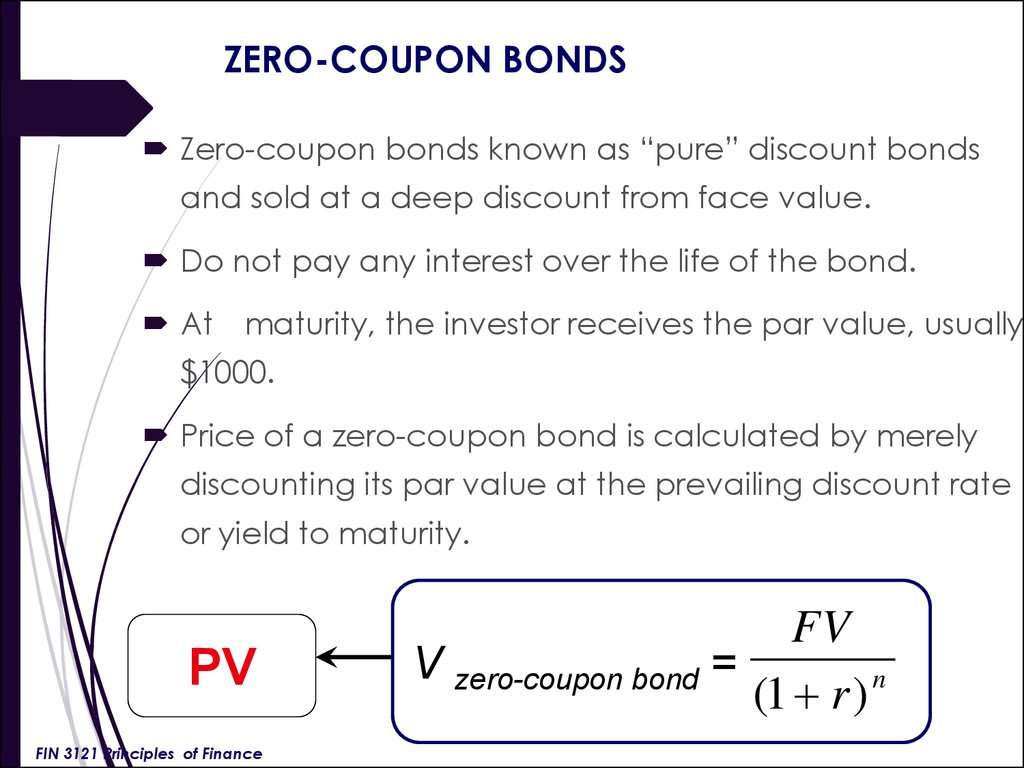

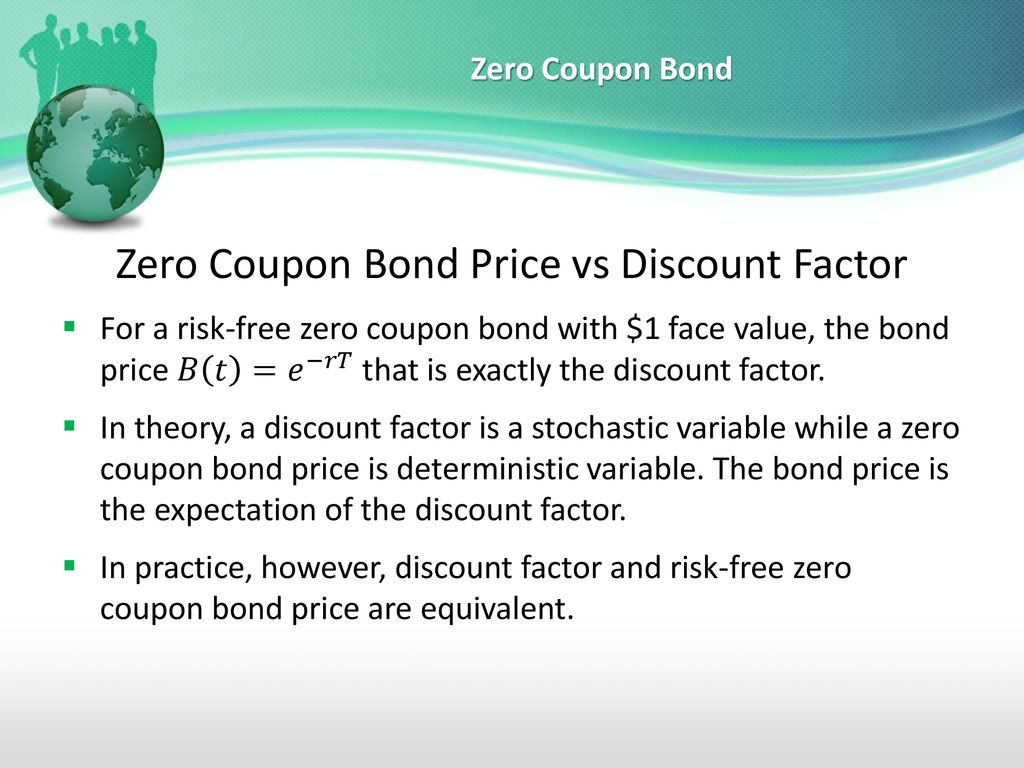

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... The price of zero-coupon bonds is calculated using the formula given below: See also Bullish and Bearish Market - Meaning, Relevance, and more Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Valuing Zero-Coupon Bonds A zero-coupon bond is one that does not pay interest over the term of the bond. Instead, the entity will sell the bond at lower than face value. When the bond's term is over, the issuing business will repay the bond at its face value. The bondholder generates a return paying less than what he receives in payment at the end of the bond's term. Valuing a zero-coupon bond | Mastering Python for Finance - Packt A zero-coupon bond is a bond that does not pay any periodic interest except on maturity, where the principal or face value is repaid. Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, is the annually compounded yield or rate of the bond, and is the time remaining to the maturity of the bond.

› gb › enBond valuation and bond yields | P4 Advanced Financial ... The plain vanilla bond with annual coupon payments in the above example is the simpler type of bond. In addition to the plain vanilla bond, candidates – as part of their Advanced Financial Management studies and exam – are required to have knowledge of, and be able to deal with, more complicated bonds such as: bonds with coupon payments occurring more frequently than once a year ...

› instructions › i706Instructions for Form 706 (09/2022) | Internal Revenue Service Entering zero for any of items 1 through 9 is a statement by the executor, made under penalties of perjury, that the gross estate does not contain any includible assets covered by that item. Do not enter any amounts in the “Alternate value” column unless you elected alternate valuation on Part 3—Elections by the Executor , line 1.

How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ...

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

Valuation of Zero-Coupon Bonds - YouTube Valuation of Zero-Coupon Bonds 7,659 views Mar 22, 2020 68 Dislike Share Save Pat Obi 15.2K subscribers This video provides an explanation of a zero-coupon bond and proceeds to show how the...

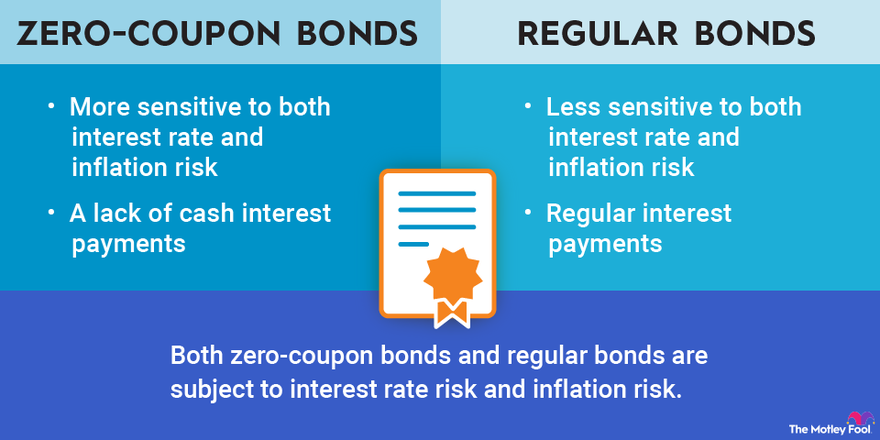

quizlet.com › 517145219 › sophia-pathways-principlesSOPHIA PATHWAYS Principles of Finance unit 2 - Quizlet b.)Longer-term bonds are less sensitive to interest rate risk than shorter-term bonds. c.)Bonds held until maturity have greater exposure to interest rate risk. d.)It stems from the fact that coupon rates and market interest rates are directly correlated.

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

en.wikipedia.org › wiki › ArbitrageArbitrage - Wikipedia Investor longs the zero-coupon bonds making up the related yield curve and strips and sells any coupon payments at t 1. As t>t 1, the price spread between the prices will decrease. At maturity, the prices will converge and be equal. Investor exits both the long and short positions, realising a profit.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds. To illustrate, assume that on January 1, Year One, a company offers a $20,000 two-year zero-coupon bond to the public. A single payment of $20,000 ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Solved 2. Valuing a Zero-Coupon Bond. Assume the following - Chegg Question: 2. Valuing a Zero-Coupon Bond. Assume the following information for existing zero-coupon bonds: Par value = $100,000 Maturity = 3 years Required rate of return by investors = 12% How much should investors be willing to pay for these bonds? ANSWER: PV of Bond = PV of Coupon Payments + PV of Principal $0 + 100,000 (PVIF-12% -3 ...

How to Calculate the Price of a Zero Coupon Bond Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00 00:00.

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ...

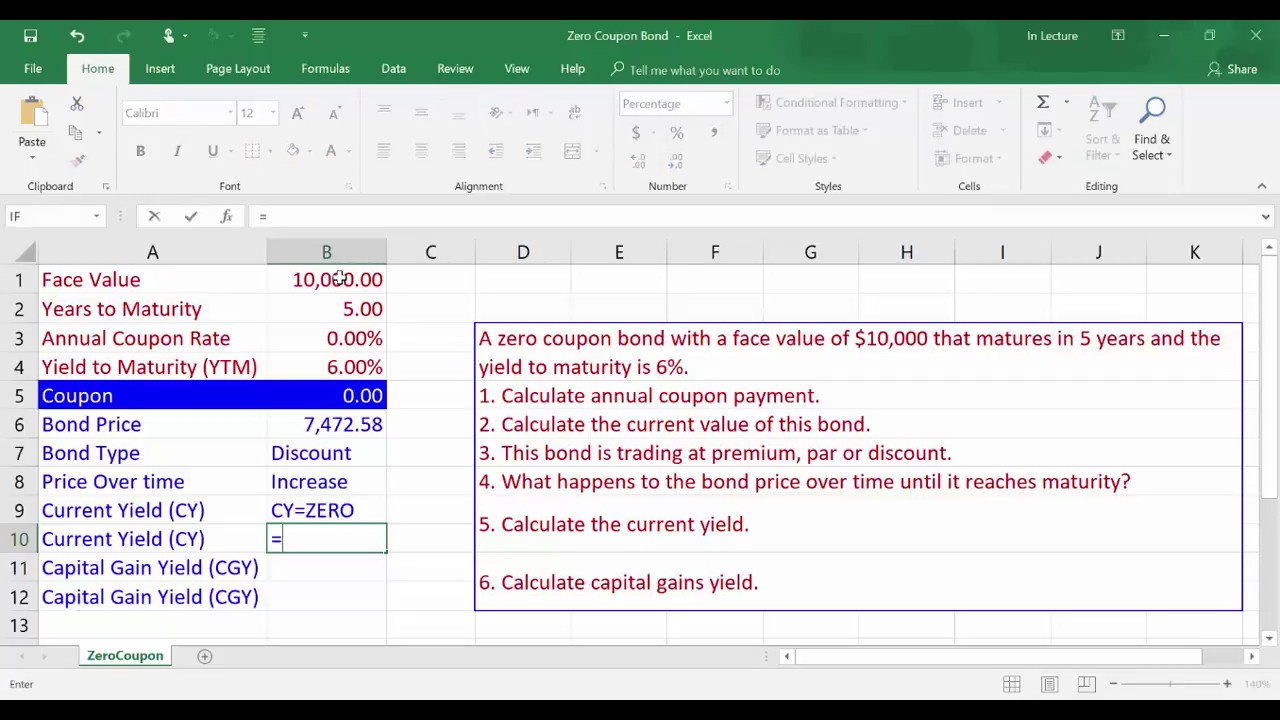

Zero Coupon Bonds Explained (With Examples) - Fervent Valuing Zero Coupon Bonds on Excel® We'll be using Excel's "PRICE" function to value Swindon Plc's bond. The first thing you want to do is setup your spreadsheet with a pro-forma / template that consists of the all different variables you'll need. The "PRICE" function on Excel® requires:

Valuing a zero-coupon bond | Mastering Python for Finance - Packt Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, y is the annually-compounded yield or rate of the bond, and t is the time remaining to the maturity of the bond. Let's take a look at an example of a five-year zero-coupon bond with a face value of $ 100. The yield is 5%, compounded annually.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For...

Post a Comment for "45 valuing zero coupon bonds"