45 zero coupon bond benefits

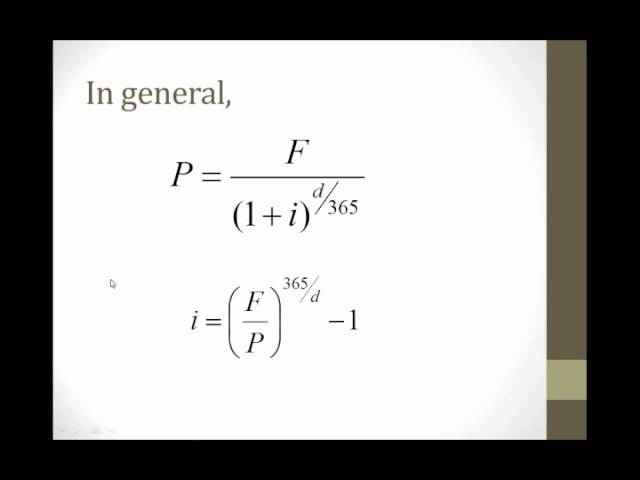

LDI: the better mousetrap that almost broke the UK Buy a zero-coupon bond that matures on that date! Easy. We don't live in a simple world, though. Exactly, and that's where things get messy. Until a pension plan is fully funded and frozen (meaning... Bond Noob question : r/bonds - reddit.com I am new to bonds. I have a question, I am looking at UNITED STATES TREAS BILLS ZERO CPN 0.00000% 01/24/2023 (yield 3.58, yield to worst 3.529, yield to maturity 3.529, 3rd party price 98.868, maturity date 01/24/2023).. Does this mean that on a $100k the bond will pay $3529 after 3 months guaranteed? Are bonds bought at market price or should I set a limit?

What Does It Mean When a Bond Has a Sinking Fund? - Investopedia The bonds would likely pay interest payments (called coupon payments) to their owners each year. In the bond issue's final year, CTC would need to pay the final round of coupon payments and also...

Zero coupon bond benefits

I bond gift box : r/bonds - reddit.com The 10k limit is summarily for purchases and accepting gifts, so if you purchase 10k this year, you can't accept another 10k as a gift the same year. And if you accept it as a gift in 2023, you won't be able to buy another 10k in 2023. Hope it makes sense. So, whichever way you are tiring to get more than 10k per year, i don't think it's possible. › article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity. › the-basics-of-bondsThe Basics Of Bonds - Investopedia Jul 31, 2022 · Convertible Bond: Definition, Example, and Benefits. 12 of 28. High-Yield Bond. ... What is the difference between a zero-coupon bond and a regular bond? 21 of 28. How Bond Market Pricing Works.

Zero coupon bond benefits. Short-Dated Term Premia and the Level of Inflation The chart below plots the yield and term premium for a two-year zero-coupon bond in the Adrian-Crump-Moench (ACM) term-structure model from January 1962 to June 2022. The chart shows that the historical term premium estimates were at their peak during the high inflation period of the late 1970s and early 1980s; estimates of the term premium ... Some bonds on secondary market are essentially "Zero-Coupon" bonds With yields rising, many older bonds are selling at a discount but their coupon can be relatively low (e.g 0.9%). With the discounted purchase price the YTW can be much higher (e.g. 3.8%). But the YTW takes into account the fact that you purchased the bond at a cost of less than $1000, and when it's redeemed you will receive $1000. LDI: the better mousetrap that almost broke the UK Buy a zero-coupon bond that matures on that date! Easy. We don't live in a simple world, though. Exactly, and that's where things get messy. Until a pension plan is fully funded and frozen (meaning it has no new participants or benefits), there isn't any way to know for sure what its liabilities will be in the future. Pakistan Government Bonds - Yields Curve The Pakistan 10Y Government Bond has a 13.163% yield. Central Bank Rate is 15.00% (last modification in July 2022). The Pakistan credit rating is B-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 505.92 and implied probability of default is 8.43%. Residual.

Bonds vs Bond-ETFs : r/bonds - reddit.com Are there reasons why should I buy a bond ETF (e.g. this one in particular) over a bond directly? There are 2 types of bonds, government bonds, which generally are considered to have zero(or near zero) default risk(but have other risks, such as interest rate, inflation and duration risks to name the most common). Turkey Government Bonds - Yields Curve The Turkey 10Y Government Bond has a 11.590% yield.. 10 Years vs 2 Years bond spread is -280 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 12.00% (last modification in September 2022).. The Turkey credit rating is B+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 773.86 and implied probability of default is 12 ... en.wikipedia.org › wiki › Warrant_(finance)Warrant (finance) - Wikipedia Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce the interest rate that must be offered in order to sell the bond issue. Example. Price paid for bond with warrants ; Coupon payments C; Maturity T; Required rate of return r; Face value of bond F r/bonds - zero coupon tbills. I am new to tbills, I have started buying ... 6.3K subscribers in the bonds community. The biggest community on Reddit related to bonds. ... I have started buying tbills but have been choosing zero coupon. Is there an advantage to buying non-0 coupon tbills, comments sorted by Best Top New Controversial Q&A Add a Comment . ... r/bonds • YTM and Tax Benefits for US Treasuries.

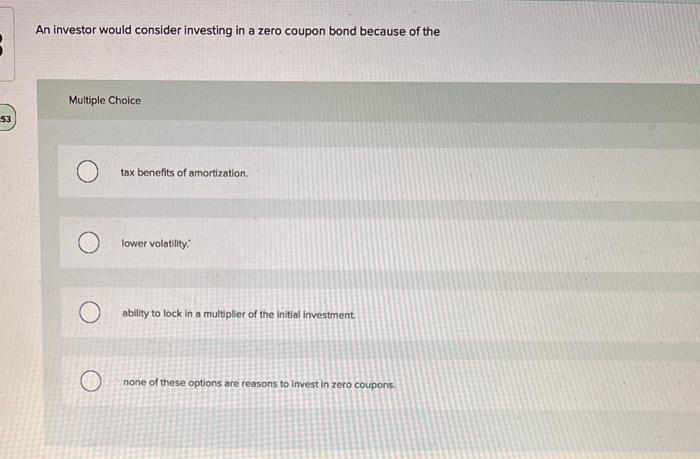

Should I Buy Bonds To Build Wealth? Wealthy People Don't The Allure Of Zero Coupon Municipal Bonds. Best Bond Alternative: Real Estate. ... First, the tax benefits on muni bonds (I wouldn't really hold regular bonds in a taxable account). Muni ETFs right now yield about 2%, which is the same as the S&P 500 dividend yield, but are not taxed. And probably most importantly is the negative correlation ... › zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Treasury Bills, Government Securities & State Development Loans Debt instruments issued by Government of India, Helps the Government in managing their debt obligation. Provide fixed interest payout on a half yearly basis, Retail investors can participate through Primary and Secondary markets, How it works? Investor, Capital is regarded as laon, Bond Issuer Government, coupons, What Is A Bond? - Bonds Online This way, the company benefits from the initial sales of the bonds to fund their project, and the bondholders get the advantage of owning stock in it if all goes well. Zero Coupon Bond, Zero coupon bonds are sold at a fraction of the price of their face value in exchange for no interest payments.

› terms › iImputed Interest Definition - Investopedia Apr 25, 2022 · Imputed interest is used by the Internal Revenue Service (IRS) as a means of collecting tax revenues on loans or securities that pay little or no interest. Imputed interest is important for ...

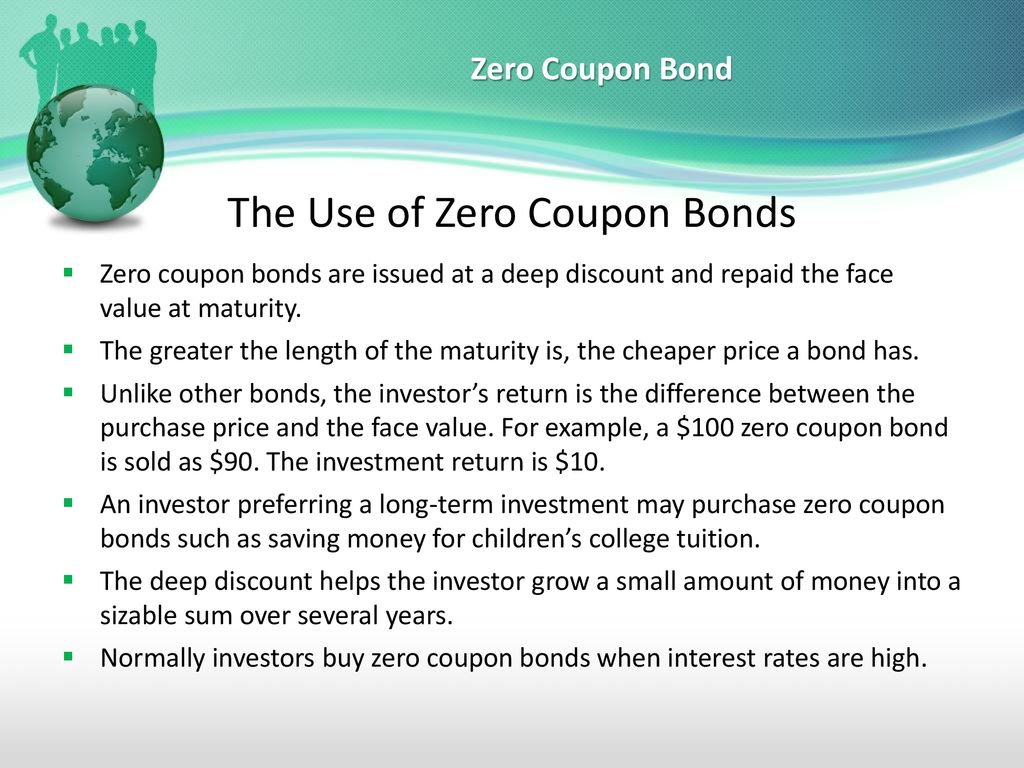

Zero Coupon 2025 Fund | American Century Investments Each Zero Coupon fund invests in different maturities of these debt securities and has different interest rate risks. The fund can only offer a relatively predictable return if held to maturity. Investment in zero-coupon securities is subject to greater price risk than interest-paying securities of similar maturity.

Mutual Funds Vs Bonds: Where to Invest? - indmoney.com Government bonds, convertible and non-convertible bonds, zero-coupon bonds, municipal bonds, and other forms of bonds are available for investment. Benefits of Bonds Investment, Predictable and Stable Returns: They give you a steady stream of money. Bonds typically pay you interest twice a year.

How to Invest in Bonds | The Motley Fool Not all bonds pay interest. Some bonds, known as zero-coupon bonds, offer a return once they've matured. Because these bonds don't pay interest, they are usually sold for a deep discount to their...

Different Types of Swaps - Investopedia Benefits: Paul pays (LIBOR+0.5%) to the lender and 10.10% to the bank, and receives LIBOR from the bank. His net payment is 10.6% (fixed). The swap effectively converted his original floating...

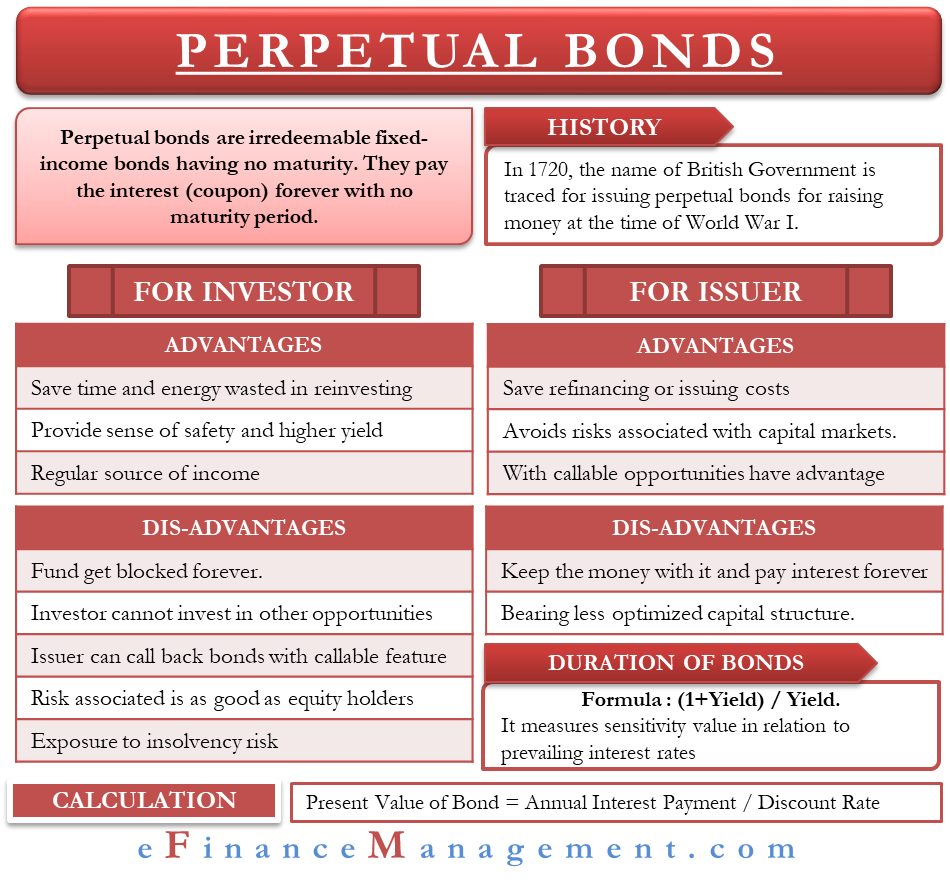

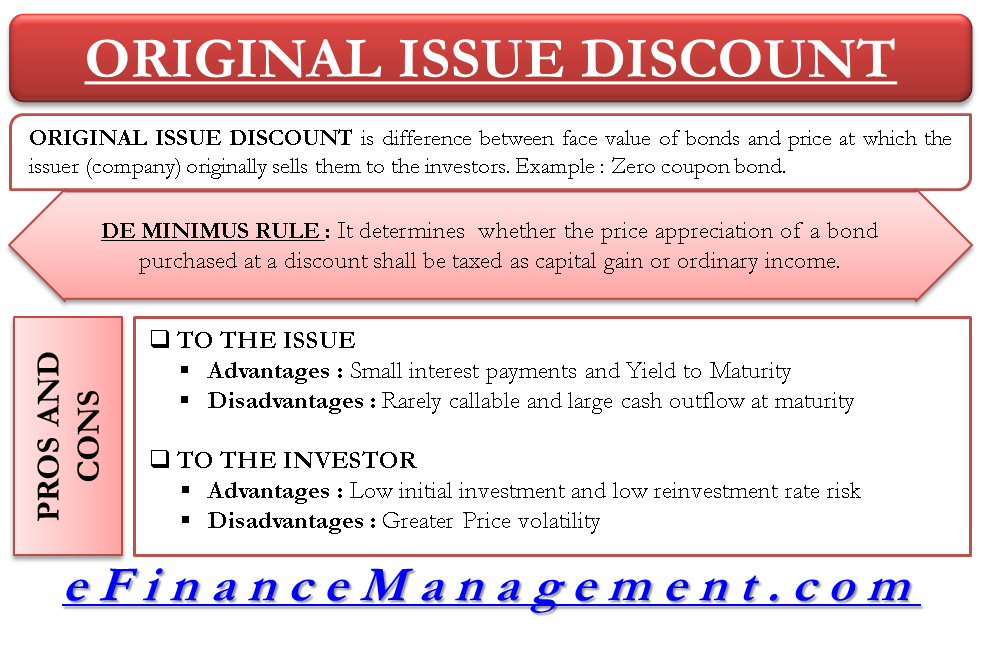

efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor.

› government-bondsGovernment Bonds: Types, Benefits & How to Buy ... - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction.

Minute Loan Heart | Vocational Training in Sri Lanka As an alternative, borrowers promote bonds at a deep discount to their face value, then pay the face worth when the bond matures. Customers should note that the calculator above runs calculations for zero-coupon bonds. The benefit of a no credit verify mortgage to the buyer is usually a quick and easy application course of with funds made out ...

Bonds of Mass Destruction - The Last Bear Standing A 10% coupon bond will pay $400 dollars in interest payments that are received ratably over a 40 year period, whereas a 1% coupon bond will only pay $40 dollars in interest. The cash flow of the lower interest bond is much more weighted to the repayment at maturity.

› the-basics-of-bondsThe Basics Of Bonds - Investopedia Jul 31, 2022 · Convertible Bond: Definition, Example, and Benefits. 12 of 28. High-Yield Bond. ... What is the difference between a zero-coupon bond and a regular bond? 21 of 28. How Bond Market Pricing Works.

› article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity.

I bond gift box : r/bonds - reddit.com The 10k limit is summarily for purchases and accepting gifts, so if you purchase 10k this year, you can't accept another 10k as a gift the same year. And if you accept it as a gift in 2023, you won't be able to buy another 10k in 2023. Hope it makes sense. So, whichever way you are tiring to get more than 10k per year, i don't think it's possible.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

/GettyImages-1169665828-e5e668e6aa454b60b5d06e110711eff3.jpg)

Post a Comment for "45 zero coupon bond benefits"