40 how to calculate coupon rate from yield

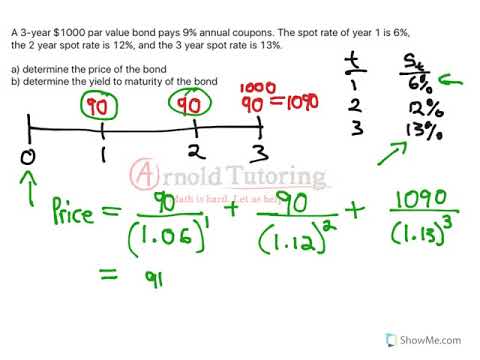

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Oct 10, 2022 · Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made all of its future interest payments and ... How Do I Calculate the Yield of an Inflation Adjusted Bond? Jul 18, 2022 · The real yield calculation would use the secondary market price (like any other bond) of $925, but use the inflation-adjusted coupon payment of $42. The real yield would thus be: 4.54% (42 ÷ 925).

Internal Rate of Return (IRR) Rule: Definition and Example - Investopedia Aug 24, 2022 · Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount ...

How to calculate coupon rate from yield

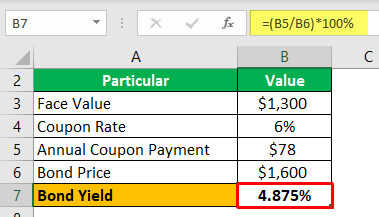

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. How to Calculate Bond Yield in Excel: 7 Steps (with Pictures) - wikiHow Mar 29, 2019 · Enter the following values in the corresponding cells to test the functionality of the bond yield calculator. Type 10,000 in cell B2 (Face Value). Type .06 in cell B3 (Annual Coupon Rate). Type .06 in cell B3 (Annual Coupon Rate). Type .09 into cell B4 (Annual Required Return). Type 3 in cell B5 (Years to Maturity). Type 1 in cell B6 (Years to ... How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow May 06, 2021 · To calculate the approximate yield to maturity, you need to know the coupon payment, the face value of the bond, the price paid for the bond and the number of years to maturity. ... Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. Remember, though ...

How to calculate coupon rate from yield. Learn to Calculate Yield to Maturity in MS Excel - Investopedia Mar 21, 2022 · Suppose the coupon rate on a $100 bond is 5%, meaning the bond pays $5 per year, and the required rate—given the risk of the bond—is 5%. Because these two figures are identical, the bond will ... How to calculate Discount Rate with Examples - EDUCBA Discount Rate = 2 * [($10,000 / $7,600) 1/2*4 – 1] Discount Rate = 6.98%; Therefore, the effective discount rate for David in this case is 6.98%. Discount Rate Formula – Example #3. Let us now take an example with multiple future cash flow to illustrate the concept of a discount rate. Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow May 06, 2021 · To calculate the approximate yield to maturity, you need to know the coupon payment, the face value of the bond, the price paid for the bond and the number of years to maturity. ... Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. Remember, though ... How to Calculate Bond Yield in Excel: 7 Steps (with Pictures) - wikiHow Mar 29, 2019 · Enter the following values in the corresponding cells to test the functionality of the bond yield calculator. Type 10,000 in cell B2 (Face Value). Type .06 in cell B3 (Annual Coupon Rate). Type .06 in cell B3 (Annual Coupon Rate). Type .09 into cell B4 (Annual Required Return). Type 3 in cell B5 (Years to Maturity). Type 1 in cell B6 (Years to ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Post a Comment for "40 how to calculate coupon rate from yield"